The History of Gap Blue Jean World Standard Jacket

B ring to mind, if you will, Gap's classic logo hoodie. You know the one: three bold letters arranged in an arch across the chest. It was everywhere in the 1990s and 00s, sold in a rainbow of saturated colours. This sweatshirt didn't signal a taste for fashion so much as a desire for comfort at a reasonable price. It was like the air we breathed, or the muzak floating around as we prowled the mall, ever-present and hardly worth remarking upon.

Over the years, the sweatshirt faded out of view, until, in 2020, an odd thing happened: it suddenly became a hot fashion item at the hands of gen Z. On Instagram and TikTok, stylish young influencers started posting photos and videos of themselves wearing Gap hoodies. Suddenly these hoodies looked rather hip and cool. The YouTube star Emma Chamberlain posted a series of photos of herself on Instagram, her expression oscillating between detached, sleepy, and slightly mournful, as she stood next to a pool wearing white bikini bottoms and a navy Gap logo hoodie. The post received more than 2.4 million likes.

Over the next few months, numerous influencers incorporated the sweatshirt into their outfits on social media. Barbara Kristoffersen, a Danish influencer with almost 748,000 followers on Instagram, wore a brown Gap hoodie with wide-leg brown pants and a matching Louis Vuitton handbag. The UK-based Lucy Page, with 12,400 followers on Instagram, wore it with cow-print pants and chunky sneakers. "I wish I could tell my younger self that she'll be back to wearing GAP hoodies in the future," Page wrote on Instagram.

Soon enough, TikTok's amateur fashion commentators were declaring the Gap logo hoodie a full-on trend. What happens on fashion TikTok tends to be fleeting, but sometimes these trends are signs of broader shifts in the culture. Natalie Langhorne, who posts fashion-related videos on TikTok, told me that conditions were prime for a Gap comeback. Young shoppers were going wild for logo-heavy clothes from brands like Nike, Gucci and Louis Vuitton, and, chronically nostalgic for the recent past, they were adopting "Y2K fashion" in droves. "Gap literally fits all of that criteria," said Langhorne, who is 24 and lives in Philadelphia. Influencers were making Gap hoodies the focal point of their outfits, elevating them from an everyday default to a fashion statement. Last summer, hoping to capitalise on this flurry of interest, Gap released a limited edition version of the brown logo hoodie and asked TikTok users to vote for the next colour. Influencers like Kristoffersen started featuring the hoodie in Instagram posts sponsored by Gap; Langhorne has received several sweatshirts as a gift from the brand.

Gap needed the buzz. Once one of the biggest names in retail, the San Francisco-based chain has been struggling for the better part of two decades, as shoppers have migrated toward more stylish and less expensive brands. Its position has slipped within its parent company, Gap Inc, which also owns Old Navy (budget-conscious clothes for the family), Athleta (workout gear for women), and Banana Republic (office wear for young people). As its original brand, Gap may still be the corporation's spiritual foundation, but it is no longer central to its financial success. In 2021, Old Navy, with its cheerful, family-friendly basics (matching patterned pyjamas for the holidays, and so on), brought in more than $9bn of revenue – more than twice as much as Gap itself.

Gap is now in the midst of a three-year turnaround plan, unveiled in 2020 by its CEO Sonia Syngal. By 2023, Syngal hopes that Gap will represent a smaller portion of Gap Inc's overall business but will be profitable. That has meant cost-cutting: closing stores, moving out of malls and shifting to a franchise business in the UK and Europe. It has also involved design changes. While Gap is focusing on its most successful categories – denim, activewear, fleeces and knitwear – it grabbed headlines in June 2020 when it announced a 10-year collaboration deal with Yeezy, the influential fashion brand run by the artist formerly known as Kanye West, who recently changed his name to Ye.

There are some signs that Gap is moving in the right direction. Sales in North America were up in 2021, prompting Gap Inc, in its most recent annual report, to declare its namesake brand "cool and relevant again". Still, for all the TikTokers buying logo hoodies and Ye fans snapping up Yeezy Gap, the retail experts I spoke with were not optimistic about the brand's future. One problem that kept coming up was Gap's lack of any clear identity, a crucial factor in the long-term success of any clothing brand. "I think for years, the challenge has been that there has been no clear point of difference for Gap," said Allen Adamson, a co-founder of the retail consultancy Metaforce. Gap's squishy new tagline, Modern American Optimism, doesn't offer much help. (Nor do vague words of encouragement feel especially meaningful at this less-than-sunny moment in US history.) These identity questions remained hazy even after I received an emailed statement from Gap laying out its intention to both "provide something for everyone at every stage of their life", and to focus on capturing millennial and gen Z customers.

When it first hit the scene in the late 60s, Gap was speaking to a generation of young people. Today, the brand faces the challenge of clarifying a message that has grown blurry.

A s people who spend too much time on social media know, gen Z likes to make fun of boomers, but it has that generation to thank for Gap's ascendance. The first Gap store opened in 1969 in San Francisco, the hotbed of the hippy movement, and it sold records, and blue jeans made by Levi Strauss, a company based in the same city that had been producing denim since 1853. The story goes that Gap's founder, a then-41-year-old real-estate businessman named Donald Fisher, accidentally ordered a pair of Levi's in the wrong size and couldn't find a local store where he could exchange them for the right one, so he decided to open a store that carried the brand in a suitably large range of sizes. While the idea for the store catered to Fisher's own needs, it spoke directly to the generation that followed his: baby boomers, who were in their early 20s when "The Gap" – so named for the generation gap between that cohort and their parents – opened its doors. Baby boomers were eager adopters of blue jeans as everyday clothes, and Gap had blue jeans to spare.

Thanks to its sturdy construction, denim was originally worn by farmers, miners and industrial workers, but in the mid-20th century, it became the perfect uniform for young people interested in rejecting social hierarchies. On American college campuses in 1960, you would have found young men wearing blazers, ties and corduroys and young women in wool tweed skirts and sweaters, said Regina Blaszczyk, a professor of business history at the University of Leeds. But, she continued, "By the end of the decade, they're wearing jeans." And by the 1970s, this look, like other elements of the counterculture, had gone mainstream.

Riding the denim craze, Gap expanded across the country, launching its own Gap label to sell alongside Levi's jeans, and went public in 1976. (Fisher phased out selling records early on, when it became apparent that jeans were a much bigger draw.) But because Gap relied on Levi's so heavily, it was vulnerable to the other company's fortunes. After the Federal Trade Commission accused Levi's of price-fixing in 1976, Gap missed its target stock price at IPO. When that ruling gave other retailers permission to mark down Levi's goods, Gap faced pressure to drop its own prices to remain competitive. "It became a big enough problem that Gap strategically felt they had to migrate away from Levi's," said Mark Cohen, the director of retail studies at Columbia Business School, who worked for Fisher in the late 70s. Gap tried new ideas – Cohen worked on a short-lived brand called Logo, which catered to an older audience that couldn't wear jeans to work (Cohen describes it as "kind of a precursor to Banana Republic") – and introduced a wider variety of clothing to its stores, but it had little success.

Then, in 1983, Fisher made a brilliant move. Seeing how well the women's clothing chain Ann Taylor was performing, he decided to hire the person behind its success. That was Millard "Mickey" Drexler, who went on to turn Gap into a global juggernaut. Drexler left Ann Taylor on a Friday, flew to San Francisco over the weekend and started his new job as president of Gap on the Monday. "It was a business without taste or style, or a point of view," Drexler told me. He planned to make colour a cornerstone of Gap's sensibility and pare down the number of styles it sold. He planned to give it an identity.

If you don't know Drexler's name, you certainly know his work. After nearly 20 years at Gap, he moved to J Crew, the US's foremost purveyor of preppy New England style, turning it into a hit machine favoured by Michelle Obama and Gwyneth Paltrow. As an Apple board member, a role he occupied from 1999 to 2015, he also helped Steve Jobs design the concept for the brand's clean, minimalist stores. A native New Yorker, Drexler approaches conversations like a voluble, hyper-focused whirlwind and in the business world, he has a reputation for being a merchandising genius. Put simply, he knows what people are going to want to wear, how much of it to buy and how to price it. "You kind of have an emotional thermometer inside you," Drexler told me over the phone. "If you don't have that, you can't do this business well."

When he arrived at Gap, Drexler started liquidating the company's inventory, marking down prices to clear. This is a common way for retailers to get rid of dead weight, but the process was terrifying to Drexler. It was his first time working at a public company, and its earnings and stock price were plummeting. "I'm scared shitless inside," said Drexler, recalling that period of his life. He'd come home at night to his wife, Peggy, and wonder what on earth he was doing at Gap.

Drexler's strategy was to introduce a line of casual, classic, affordable clothing suited to the middle class baby boomers who were now establishing themselves in their careers and starting families. Under Drexler, Gap found hits in items like its jeans, fleeces and 10-button henley shirts. As he had planned, bold, crisp colour became its calling card. Gap polo shirts were not just blue, black or white; they now came in fuchsia, red and jade green, too.

Gap sold the building blocks of unfussy American style, and it sold them to everyone. At the time, most other clothing retailers thought about their customers in rigid terms, dividing stores up according to age groups and price categories. Drexler "just crashed through all of that", said the former Harper's Bazaar editor Kate Betts, who worked in Paris as a fashion reporter for the trade publication Women's Wear Daily during the late 80s. At Gap, where the lines blurred between men's and women's clothing, everyone could get in on the look – not just baby boomers, but their kids, too.

Drexler's plan took more than a year to start showing results, but when it did, as he immodestly puts it, the brand took off like a rocket. Between 1984 and 1985, Gap Inc's annual revenue jumped from $518m to $647m. By 1990, sales had reached $1.93bn. At that point Gap really did, as it is hoping to do today, provide something for everyone.

D rexler's Gap was born into a golden age of American retail. In the 80s, suburban malls were booming, having become a hangout spot for teenagers, who flocked to their buffets of chain stores, food courts, and movie theatres. Specialty apparel stores, the retail category to which Gap belongs, started to dominate. Gap wasn't merely riding that wave: "It definitely led the way," said Steven Goldberg, a retail veteran who heads the consulting firm SGG & Associates.

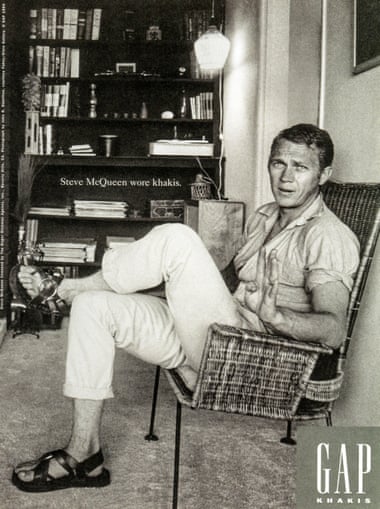

Today, you can't go online without bumping into a brand selling casual basics, from Uniqlo to the five different no-name brands that keep advertising "the perfect tank top" on your Instagram feed. In the 80s, though, the revamped Gap had little competition. When I asked Cohen, the Columbia Business School professor, who it was going up against, he answered with one word: "Nobody". Gap clothes struck a balance of being stylish but not intimidating, affordable but good quality. The brand fit with an increasingly relaxed clothes culture, and when many American workplaces adopted the practice of "Casual Fridays" in the 90s, Gap was right there with an armful of khakis.

Gap had found its point of view, and it was Drexler's. "Mickey was the north star. There's no question," said Jen Foyle, the president and executive creative director of the clothing brand American Eagle and its offshoot Aerie, who worked as a Gap merchant in the late 90s and early 00s. Over the course of his career, Drexler has been known for his hands-on approach. At Gap, the lead-up to what Foyle calls "Mickey meetings", in which each merchant would present the buys for their department or division, came with a rush of adrenaline. Everyone was paying attention to what he did and didn't respond to, who performed well and who didn't. "When he stayed on a product for a minute, you knew there was something not right about it, or the buy wasn't right, or something was mis-ranked," said Foyle.

In the 80s, Gap's sense of identity was clear to shoppers, too. "Gap was so pure and simple," said Scott Sternberg, a fashion designer who looked to that era of Gap as a source of inspiration when launching his own colourful essentials brand, Entireworld, in 2018. Sternberg is 47 and grew up in Dayton, Ohio, where he used to go to the Gap store in the local mall. It was a one-stop shop where he would buy everything from khakis and jeans to T-shirts and socks. Sternberg feels that Drexler's Gap allowed shoppers to build a cohesive wardrobe over time, creating a utopian order where the products were all compatible, regardless of when you bought them.

During this period, Gap was selling the notion that its classics were for everyone, but that each person wore them in their own way – an ethos that dovetailed with changing tastes in the fashion world. "The idea of 'personal style' was becoming a huge catchphrase in the fashion industry at that time," said Betts, who remembers seeing the term on magazine covers when she went to work at Vogue in 1991. Previously, people who wore designer clothing tended to dress in a single brand from head to toe, but heading into the 90s, designers and editors started favouring a more individualised "high-low" look, mixing designer pieces with blue jeans or a T-shirt. On Anna Wintour's first cover as editor-in-chief of Vogue in 1988, the model Michaela Bercu wore an embroidered Christian Lacroix haute couture jacket with a pair of Guess jeans.

Not everyone had the means to wear their Gap jeans with a designer jacket, of course, but the simplicity of the brand's clothing meant that it was versatile enough to be incorporated into any number of looks. "The secret power of Gap is that the product was meant to be a person's own," said Trey Laird, an advertising executive hired by Drexler in 2001 to work on Gap's ads. "If you were walking down the street, nobody would stop you and be like, 'Oh my God, you're wearing the Gap skinny black pants!' They were your black pants."

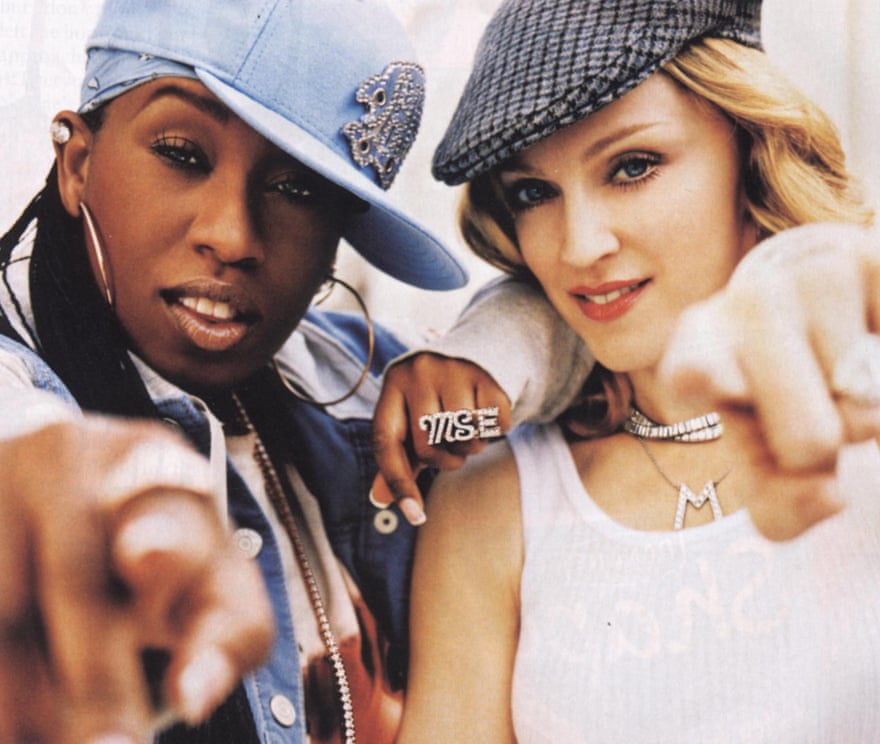

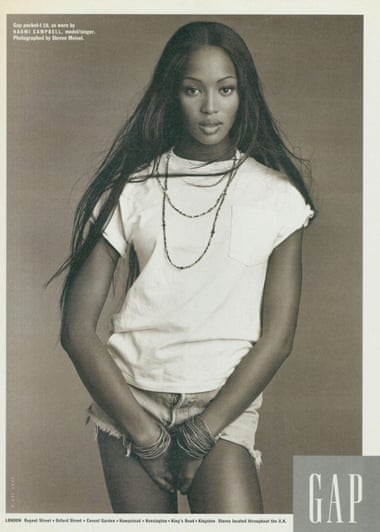

Gap made this message clear in its 1988 "Individuals of Style" advertising campaign, which became the blueprint for many of its later ads. Shot by the biggest names in fashion photography, such as Patrick Demarchelier and Annie Leibovitz, the ongoing campaign featured black and white images of celebrities wearing Gap. Spike Lee in a mock neck and khakis, Whoopi Goldberg in a hooded sweatshirt, Joan Didion and her daughter Quintana Roo in turtlenecks. The photos were simple and elegant. The stars really did look as if they were wearing their own clothes, in their own way. "I remember thinking that it was just so cool," said Betts. "You'd never seen that kind of stylised campaign on a mass market level before." Over the years, everyone from Willie Nelson and Lucy Liu to Mikhail Baryshnikov and Amy Poehler appeared in ads for the brand. To sit for a Gap ad became almost a rite of passage. Working with Hollywood stars is now an obvious move for every brand that can afford it, but for a period of time, as Sternberg said, "They owned celebrity."

Gap found a way to make the idea of wearing the same clothes as everyone else seem cool. In 1999, the brand released a trio of low-key but iconic TV commercials. In one, a group of people wearing muted shades of blue and gray sat on a white set and sang portions of the Donovan song Mellow Yellow as the camera panned around the room. While some of the cast would later go on to become famous – you can spot a young Rashida Jones in the group – nobody stood out, as such. The commercials were about being part of the group, recalled the ad's director Pedro Romhanyi. "I think one of the reasons Gap was so successful is that it appealed to people who wanted to look stylish in the crowd, rather than stand out from the crowd," he said.

When these ads came out, Gap was ubiquitous. In 1999, it had more than 2,000 stores around the world, and Gap Inc's sales had reached $11.6bn. But competitors were closing in on Gap's previously unchallenged position in the market. Department stores had started selling jeans, khakis, and casual tops, too, and discount clothing stores like TJ Maxx, Ross and Marshalls were on the rise. To compete with these lower-priced stores, Drexler had launched Old Navy in 1994, an upbeat alternative to drab discount stores. It was an enormous success – in 1995, Fisher named Drexler CEO, while he remained at the company as board chair – but it didn't help Gap's position. After two years of sinking sales, in 2002, Drexler was out.

T he slump that preceded Drexler's departure was, at least partly, the result of product misfires. European fast fashion brands were taking off in the US – H&M opened its first US store in New York in 2000 – and the Gap team got spooked, turning their focus to trendy clothing rather than the classic items it was known for. (News articles on Drexler leaving cited "hip-huggers" and "orchid leather pants and crocheted halter tops" as examples of Gap's misguided attempts at more fashion-centric items.) "We just went in the wrong direction," said Foyle. "Now, from my heart, I'm always like, brand first, brand first. It's the best lesson I've ever learned."

Having realised the brand's error, Foyle remembers going through every clothing category and identifying the key items that had performed well for Gap in the past – a process not unlike the one Gap says it is undertaking now. "We really just went back to our roots," Foyle said. Sales did pop back up in 2003 and 2004. The following year, they began a decline that has continued, almost uninterrupted, until the present day.

Gap's fall during the 00s and 10s stems from problems much bigger than hip-huggers. Chief among them is overexpansion. In the 80s and 90s, Gap had piled up revenue by opening thousands of new stores. This strategy was standard at the time. "The market demanded that you open more doors," said Doug Stephens, a retail consultant based in Canada. "It wasn't even a choice that most companies had. In every earnings report, investors wanted to see how many new doors you had."

By the early 00s, it was clear that Gap had gone too far. ("The hardest thing for a brand to do is maintain what makes them special and yet sell to the entirety of the world," said retail analyst Simeon Siegel, noting that Nike may be the only apparel retailer in the US currently managing that.) For any brand of that size, it's a challenge to train so many new staff and keep tabs on how stores were doing, while preventing newly opened stores from siphoning sales away from established locations.

Could retailers like Gap have foreseen these problems? Cohen believes so. "It was a train wreck that could be seen at the end of a long tunnel, but nobody was acting on it," he told me. What they might not have been able to anticipate was the rise of e-commerce. As consumers have moved their shopping habits online in recent years, numerous once-mighty American department stores and popular mall brands have crumbled under the weight of their massive property portfolios – a problem that has only got worse during the pandemic. The British high street has undergone its own meltdown during Covid, with Topshop owner Arcadia Group entering administration and Marks & Spencer accelerating store closures.

Besides its excessive number of stores, Gap's offering – classic clothing for middle-class customers – no longer fitted the moment. As wealth inequality in the US grew, discount retailers TJ Maxx and Ross continued to prosper, and fast fashion brands like Forever 21, H&M and Zara drew away shoppers with their inexpensive, runway-inspired clothing. "I think that by the early 2000s, the writing was on the wall: if you're a mid-tier brand looking for middle-class consumers, you're going to have an increasingly difficult time," said Stephens.

Throughout the 00s and 10s, Gap flailed around trying to rediscover its identity. From Cohen's perspective, the three CEOs who followed Drexler – Paul Pressler, who came from Disney parks and resorts; Glenn Murphy, who came from Shoppers Drug Mart in Canada; and Art Peck, a former consultant who spent 10 years at Gap Inc under Murphy – didn't have the experience or merchandising skills to reposition Gap's business. Buzzy creative directors came and went, without rejuvenating the brand in a lasting way.

All the while, Gap was losing customers. "They didn't stand for anything any more, and the customer was confused," said retail analyst Janet Kloppenburg. Gap failed to secure the loyalty of millennials, many of whom had grown up shopping at Gap with their baby boomer parents and may still have fond memories of the logo sweatshirts and jeans that they saw in its stores. I do. When I think about the Gap of my 90s childhood, I see a store that's bright and clean, full of richly coloured sweaters, full of the transformative possibility that I felt every time I went to the mall. But Gap didn't grow up with millennials, and it lost out to the cooler, sexier mall brands vying for their attention, like Abercrombie & Fitch, American Eagle and Aeropostale. The company was created for one generation gap but failed to bridge the next.

W hich brings us to Kanye. By far the juiciest aspect of Gap's current turnaround plan is its Yeezy collaboration. Since it was announced two years ago, only a small selection of items have been made available – including puffy bolero jackets and hoodies – and reports have emerged that Gap is displeased with the slow rollout from Ye and his creative team. Still, the reaction from West's fans has been frenzied. The first Yeezy Gap hoodie retailed for $90 but according to the industry website Business of Fashion, it quickly began selling at 50% above its original price on StockX, a resale site, with the hard-to-find black version of the hoodie going for as much as $899. On YouTube, reviewers gave forensic analyses of the hoodie, discussing everything from the quality of the seams to the fall of the hood. At the start of this year, Ye announced a collaboration-within-a-collaboration with the high fashion brand Balenciaga, whose creative director, Demna, is a close friend of his. (Like Ye, the designer recently dropped his last name, which is Gvasalia.)

The announcement of Gap's 10-year deal with Ye made a splash, in part because it was a far more substantial commitment than most designer collaborations. Ye has long been a vocal fan of Gap, where he worked as a store employee during his teens. In 2015, he declared that one of his dreams was to be creative director of the brand – "the Steve Jobs of Gap". Meanwhile, Gap has a lot to gain by tapping into Ye's cultural capital and fan following, which drove the success of his earlier collaboration with Adidas. According to the New York Times, Gap believes it can reach $1bn in sales from Yeezy Gap by the five-year mark. That's assuming, of course, that we see more products.

It's hard to overstate the sway that Ye has over the fashion choices of a certain slice of the population – namely, "young men on the internet, and older men trying to retain their youth," says James Harris, who co-hosts the menswear podcast Throwing Fits. Certain silhouettes that have become popular in menswear can be traced back directly to Ye. Around the time he released his album Watch the Throne, he went for extra-long T-shirts – their length sometimes exaggerated with the addition of a leather skirt – worn with skinny pants and chunky sneakers. Currently, Ye is all about vintage jeans tucked into huge boots, worn with a hoodie or jacket that is cropped, boxy, and bulky, with exaggerated shoulders. Harris dropped a movie poster for 1999's The Iron Giant in our Zoom chat to show what he meant.

This might explain why, when journalistic dedication compelled me to buy a red version of the Yeezy Gap hoodie, I got the impression that I was dressed up as Ye himself. The double-layered cotton sweatshirt is remarkably heavy, almost like a weighted blanket, and while it bears no external logos, it has a distinctive shape: a dropped shoulder, a loose arm, a cropped but oversized fit. Very Iron Giant. Unlike the Gap black skinny pants that simply become your pants, this sweatshirt is the kind of product that might actually elicit comments on the street. It's not your hoodie, it's Ye's hoodie. After a few weeks of debating whether I could pull off wearing the sweatshirt without looking like I was trying to be younger and hipper than I am, I decided to return it. The thought of young Yeezy fans clocking it on the street made me feel old. (I'm 30.)

Drawing in younger shoppers is an existential matter for Gap. "As consumers get older, they shop less," said Kloppenburg. It's not clear that Yeezy Gap is going to convert Ye fans into Gap customers, though. Shoppers can order the products through a dedicated Yeezy Gap website. "This collaboration is good for Kanye and it's good for Kanye fans, because he can now produce and distribute at scale and at a price point that's friendlier to people who don't want to pay for luxury items," Harris said. He was less certain that it would do much good for Gap.

A number of retail experts with whom I spoke were baffled by Gap's discordant product output, which includes not only Yeezy Gap but also a home goods collaboration with Walmart. "I come back to the question: Who are you?" said Stephens. "What do you stand for as a brand? And what can consumers look to you for?"

Within the nascent microcosm of Yeezy Gap, the parent organisation has finally gained access to something it hasn't had in decades: a point of view. In the same way that Gap's identity flowed directly from Drexler during the 80s, Yeezy Gap is all about Ye's singular sensibility. But that sensibility is imported, forged outside Gap's walls and well before this deal was signed. Ye's fans will follow him wherever he goes, and when he eventually parts ways with Gap, you have to wonder what will be left behind.

Source: https://www.theguardian.com/fashion/2022/apr/05/gap-how-the-clothing-brand-lost-its-way-fashion-retail

0 Response to "The History of Gap Blue Jean World Standard Jacket"

Post a Comment