Simple and Easy Free Backtester for Stock Trading Strategies

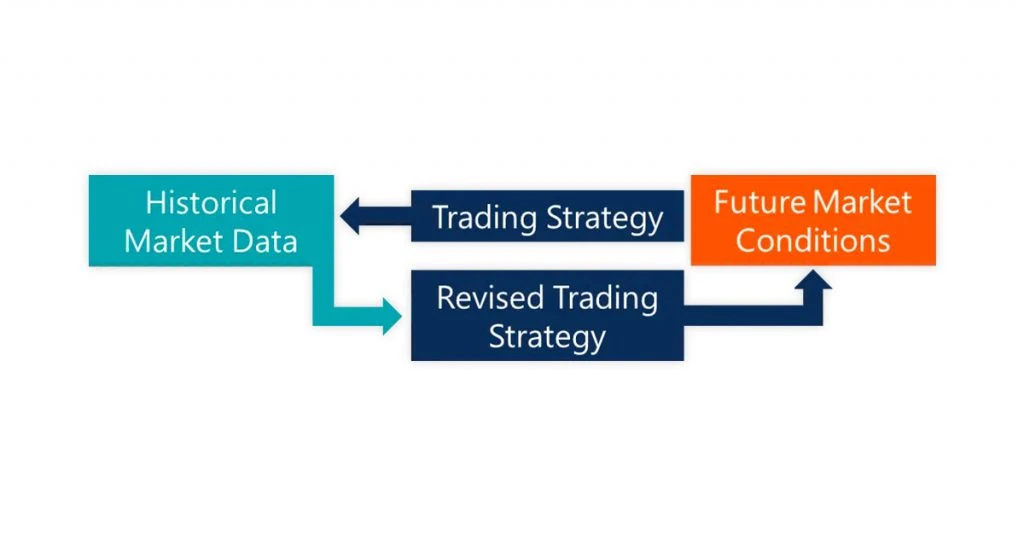

Trading stocks and options involve real money and hence any wrong decision can lead to huge losses. Due to this risk, traders use buying and selling strategies based on different criteria and rules aligning with market conditions and goals. They test these strategies before diving into the actual market.

Initially, traders used computer screens to visualize trade charts and test potential trading strategies. With advancements in technology, many vendors have developed stock backtesting software to test potential trading strategies using historical data. The test results help modify the trading strategy to maximize gains.

However, different backtesting solutions vary depending on the trading experience level, budget, nationality, system available, and other such factors. This article covers the list of backtesting software suitable for trading NSE stocks and options in India.

What Is Stock Backtesting?

Stock backtesting is a process that tests if a chosen set of fundamental or technical criteria for trading stocks has been profitable in the past.

You get detailed reports consisting of executed trades, drawdown, risk-reward ratio, compounded return, winning percentage, and more to check the effectiveness of your trading strategy.

These reports serve as a good estimate of the performance for your trading strategy and ensure that you implement correct strategies with real money so that you can make informed decisions.

What is Option Backtesting?

Option backtesting is very similar to stock backtesting, except that it tests a chosen set of criteria for trading options. Like with stock backtesting, you also get detailed reports consisting of executed trades, drawdown, risk-reward ratio, compounded return, winning percentage, and more.

Options backtesting is a great way to estimate the performance of your option trading strategy and ensure that you implement the correct strategies with real money so that you can make informed decisions.

What Is Backtesting Software?

Backtesting software tests the effectiveness of a trading or investment strategy employed in the past and helps estimate its future performance. Based on the backtesting code in the software, simulation runs on a trading strategy using historical data from financial instruments like options, stocks, and more.

The returns on the model are tested across different market conditions and datasets. Institutional investors and money managers can change different trading strategy variables and compare the viability of trading strategies to select the one that works best on historical data.

With backtesting software, traders can get information on potential net profit/loss, market exposure, volatility, risk-adjusted return, and return without risking capital.

Suggested Read: Best Technical Analysis Software for Stock Trading in India

Top 11 Backtesting Software for Effective Trading Strategy

By using the right stock backtesting software, traders can save time and money. The use of software simplifies the backtesting process and provides detailed reports. Some of the best options are discussed next.

| Backtesting Software for Option & Stock | Software Best Suitable For |

|---|---|

| TradingView | Free backtesting with pine code and sharing strategies |

| MetaTrader 5 | Testing and optimizing automated robot performance in trading |

| MetaStock | Independent stock backtesting/ forecasting |

| AmiBroker | Portfolio level backtesting and optimization |

| NinjaTrader 8 | Backtesting & optimizing automated strategies |

| TradeStation | Portfolio Backtesting and strategy customization |

| Zerodha Streak | Automated trading and backtesting for multiple instruments at once |

| TradeBrains | Advanced Portfolio Backtesting |

| Interactive Brokers | Fundamental Backtesting of Portfolio Strategy |

| TradersCockpit | Trading strategy development and backtesting |

| StockMock | Option Backtesting Software for Indian Traders |

-

TradingView

TradingView Free Trial: The software offers a free trial of the paid edition for 30 days.

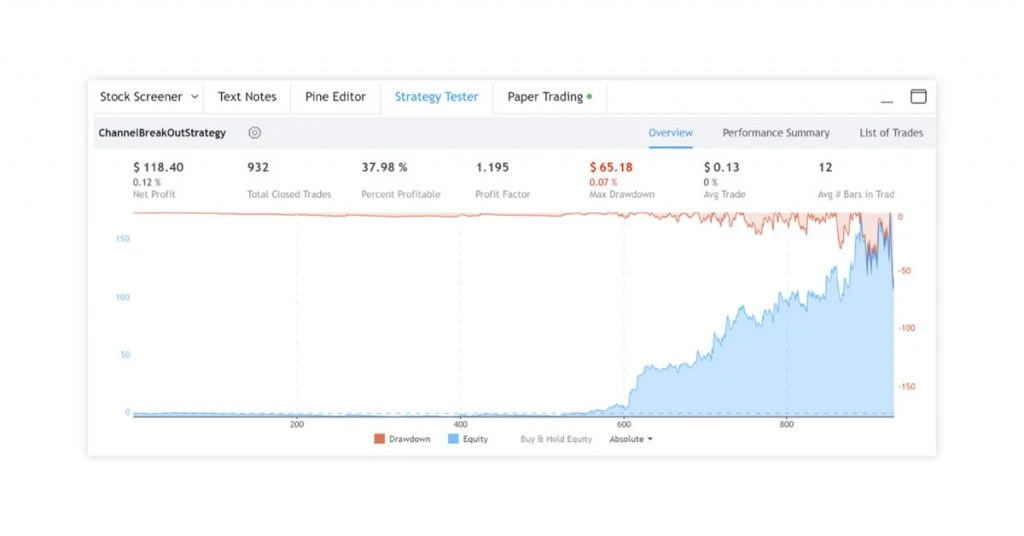

TradingView strategy tester is a web-based platform, which is popular among NSE traders and investors for forex and stock backtesting.

Its backtesting reports show the profit performance of trading strategy with parameters like percent profitable trades, net profit, charts on trade performance, number of trades, buy and hold return, etc.

Charts provide a visual reference for all trades for easy understanding. You can also vary strategy parameters to observe the impact of changes.

TradingView Features

- Market replay feature to view day-wise charts in the timeline

- Pine Script for strategy implementation

- Strategy tester manual backtesting

- Export Strategy data to CSV

- Publish ideas and scripts

TradingView Back Testing Features:

- Pine Script engine for flexible and powerful chart backtesting

- Detailed back testing reports and analytics

TradingView Pricing: You can use it as free backtesting software with limited features. There are three paid plans- Pro, Pro+, Premium with more indicators, charts, and views for backtesting. Pricing for the Pro version starts at INR 1126.47/ month.

Pros of TradingView Strategy Tester

- Control over backtesting speed

- Custom chats

- Fully synced desktop app, Android and iOS widgets

TradingView Cons

- Backtesting only for single instruments

- Not possible to implement robotic trading automation

-

MetaTrader 5

MetaTrader 5 Free Trial: The stock analysis software doesn't offer any free trial. However, Free demo account is available for individual users.

With MetaTrader Strategy Tester, you can import NSE stock data and backtest your strategies based on historical quotes of currencies, stocks and other assets.

The Metatrader backtesting platform can test strategies with default/custom indicators or those from automated trading systems called expert advisors.

Backtesting results provide detailed statistics like drawdown, balance, expected payoff, profit factor (all profits/ all losses), etc.

MetaTrader 5 Features

- Custom date option to use specific historical data for backtesting

- Testing modes for custom speed/ quality ratio

- Helps choose best input parameters for maximum profit and minimum risk

- 2D/ 3D tools to visually analyze optimization results

- MQL5 cloud network to speed up computations

MetaTrader 5 Backtesting Features: Custom manual back testing options

MetaTrader 5 Price: Brokers can choose from entry, standard, and enterprise licenses. Pricing is available on request.

Pros for MetaTrader 5

- Can test expert advisors on multiple currencies

- Speed control in visual trading mode

- Works on iOS, iPadOS, Android

MetaTrader 5 Cons: Risk of over optimization for beginners

Suggested Read: Best Professional Options Trading Software in India

-

MetaStock

MetaStock Free Trial: You can get it as free backtesting software for the first two months.

MetaStock backtesting software enables traders to backtest how well an idea, theory, or strategy previously performed. You can test different variables using artificial intelligence (AI). It provides backtesting reports with profits, draw-down, ROI and other parameters.

By clicking on any buy or sell trade, you can view size, background, profit or loss, and more. The forecast feature enables you to predict future price action from historical data.

MetaStock Features

- Power Console to access 58 systems for backtesting

- One-click backtesting of the entire market

- Custom interval selection for backtesting

- 67 event recognizers/ custom patterns for forecasting

- Real-time data with Refinitiv Xenith News service integration

MetaStock Backtesting Features

- AI enabled backtesting

- Backtesting Upto 300 Charts, volume indicator and price

MetaStock Pricing: Pricing for MetaStock starts at INR 4450.665 per month.

MetaStock Pros

- Expert advice on charts based on popular market strategies

- Training and webinars for support

- Configurable reporting for forecasting

MetaStock Cons

- Lacks automated trade execution

- Requires knowledge of scripting

-

AmiBroker

AmiBroker Free Trial: A 30-day free demo version of AmiBroker backtesting is available.

AmiBroker backtesting service enables traders to get the simulated portfolio level trades list based on the trading rules they prefer. The user must enter the formula for generating buy/sell/short/cover signals for trading rules.

You can change different settings for backtesting like maximum loss and profit target stops, amount of commission, type of trades, portfolio size, price fields, etc.

AmiBroker Features

- Custom backtesting facility

- Several backtest modes, including regular raw and rotational trading mode

- Optimization in Analysis Window

AmiBroker Backtesting Features

- AFL scripting host for advanced formula writers

- Margin Account and position sizing

AmiBroker Pricing: Standard Edition starts at INR 22, 582.72 with two threads per analysis window.

Pros of AmiBroker

- Multi-currency support

- Multi-threading support for faster backtesting and optimization

AmiBroker Cons

- Only Windows download

- Requires programming knowledge

-

NinjaTrader 8

NinjaTrader Free Trial: NinjaTrader doesn't offer any free trial.

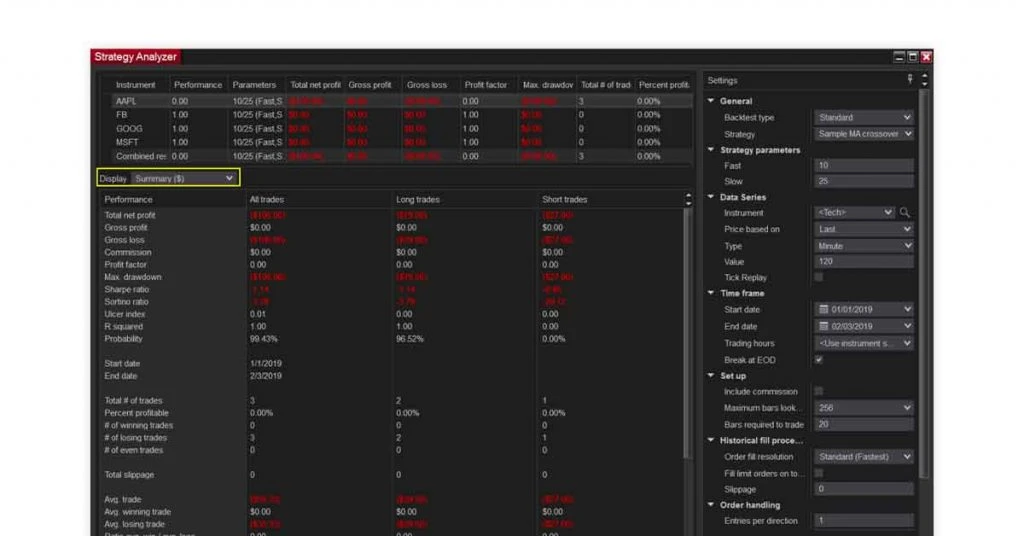

NinjaTrader Strategy Analyzer enables traders to use historical trading data to identify profit and loss attributes of their strategy to optimize performance in live market conditions.

Depending on the report style selected, you can view statistics like gross profit/ loss, total net profit, profit factor, number of trades, maximum drawdown, and more.

NinjaTrader Features

- Price-over-time charts

- Data from IQFeed, text files, Google Finance, eSignal, Yahoo finance, etc.

- Optimization to fine-tune input parameters of strategies

- 2D/ 3D optimization graphs

NinjaTrader Backtesting Features

- Pre-defined sample strategies

- Custom Strategy

NinjaTrader Pricing: There is a free plan that lacks automated backtesting. Paid plans start at INR 16969.05/ quarter.

NinjaTrader 8 Pros

- Automatic reading of trade entry/exit

- Can save Strategy Analyzer session

- Support for user-developed custom statistics

NinjaTrader 8 Cons: Does not consider price action and news events.

Suggested Read: Top Nifty Buy Sell Signal Software for Indian Stock Market

-

TradeStation

TradeStation Trial: TradeStation doesn't offer any free trial.

TradeStation strategy tester enables day traders to analyze their trade ideas and methods for stocks, options, and futures using a large historical market database.

Performance summary provides statistics for total net profit, the total number of trades, maximum drawdown, the annual rate of return, etc.

TradeStation Features

- Look-Inside-Bar backtesting for finer data intervals

- Weekly/Monthly charts

- Parameter-based optimization process

- Strategy automation for monitoring positions and orders

TradeStation Backtesting Features

- Auto Trading

- Algorithmic trading application

TradeStation Pricing:It is free for TradeStation brokerage clients. For opening an account, you can add any deposit amount in TS Go plan and at least INR 1,51,749 in TS Select plan.

There is no commission for stocks and ETFs. Pricing starts at the rate of INR 37.94 per contract for stock options.

Pros of TradeStation

- No installation required in the web version

- Works on desktop, Android and iOS

- Multi-currency support

Cons of TradeStation: Cluttered layout

-

Zerodha Streak

Zerodha Free Trial: Zerodha offers a 7-day free trial with 50 backtests per day.

Streak Zerodha stock backtesting enables traders to build, test, and deploy strategies for stocks and cryptocurrencies without programming. Once you create or copy a strategy, you can generate performance reports for several stocks in one click.

The metrics in results include average loss per winning trade, average gain per winning trade, profit and loss curve, maximum drawdown, maximum losses/gains, among others.

Streak Zerodha Features

- Backtesting parameters like initial capital, backtest period, candle interval, stop loss percentage, and more.

- Customizable backtested sample algos for optimization

- Short-term/ long-term trend direction in real time

Streak Zerodha Backtesting Features

- Individual scrip performance details on backtest page

- Multi-time frame

Zerodha Streak Pricing: Regular plan starts at INR 690 per month and allows 300 backtests per day.

Pros of Zerodha Streak:

- Android and iOS app

- View counter to count people tracking backtest results

- Markets for live charts of instruments

Cons of Zerodha Streak: Requires strong Internet connection

-

TradeBrains

TradeBrain Free Trial: It doesn't offer free trials.

TradeBrains portal helps traders in creating backtesting strategies and implementing them. The reports include metrics like portfolio growth, CAGR, absolute returns, YOY/MOM returns on portfolio stocks, and so on.

You can also stay updated with information about the stock of different Indian companies listed at NSE and BSE.

TradeBrains Features

- Risk and return analysis for each portfolio asset

- Superstar Portfolio

- Stock themes and buckets

- DCF Analysis

TradeBrains BackTesting Features

- Multiple backtesting parameters

- Analysis segment for detailed backtesting results

TradeBrains Pricing: This backtest trading strategy free tool offers plan with 1 backtest/day. Paid plans start at INR 399/month.

Pros of TradeBrains:

- Free investing and trading courses

- Simple interface and backtesting process

TradeBrains Cons: Android app only for stock screening & analytics

-

Interactive Brokers

Interactive Brokers Free Trial: It doesn't offer free trial.

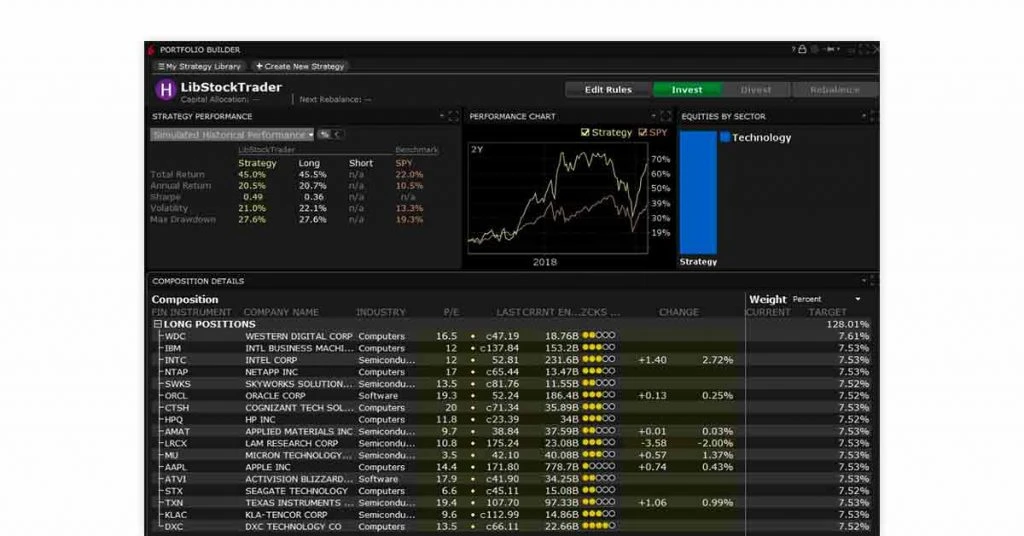

Interactive Brokers platform helps portfolio managers to do backtesting based on company fundamentals like the Acid test, P/E ratio, EPS growth, top buy-side Analyst Ratings, etc. With the Portfolio Manager tool, you can build and backtest strategies against selected benchmarks in detail.

The platform also allows optimizing the weight of positions based on the highest Sharpe ratio (a measure of risk-adjusted return), lowest variance, highest return, and more. For options, you can view potential profit and loss and risk/return ratio in Options Strategy Lab.

Interactive Brokers Features

- Automatic saving of modifications in investment rules as hypothetical strategies

- 60+ criteria to sort potential stock investments

- Strategy performance tracking

- Automatic notifications for portfolio rebalancing

- Advanced API technology

Interactive Brokers Backtesting Features: Fundamental backtesting with portfolio manager.

Interactive Brokers Price:It is free for IB clients. You can sign up for a free trial account on the platform. Pricing is available on request.

Pros of Interactive Brokers

- Up to nine years of historical performance for backtesting

- Works on desktop, mobile, web

- Customer support via telephone, chat & email contact

Interactive Brokers Cons: Not many options for backtesting on chart indicators.

Suggested Read: Best Technical Stock Screeners in India for Day Trading

-

TradersCockpit

TradersCockpit Free Trial: There is no free trial for TradersCockpit.

TradersCockpit is used by traders, investors, and brokerage firms. Strategy Labs tool helps in building and backtesting strategies with different indicators for NSE stocks.

It supports large volumes of historical data to check how a strategy works in the future. The reports include backtesting dates, average trades, total returns, cumulative percentage gain/loss, and many other metrics.

TradersCockpit Features

- EOD and Multi-frame strategies

- Detailed analysis charts

- Options/TA Workshops

- Preset Dashboard and Templates

- Optimized versions

TradersCockpit Backtesting Features: EOD and Multi-frame strategies

TradersCockpit Price: It is available at Techjockey.com for INR 24662/ year.

TradersCockpit Pros

- Cloud-based, mobile friendly

- Intuitive interface

- Hands-on workshops

TradersCockpit Cons: Advanced features for backtesting are missing.

-

StockMock

StockMock Free Trial: There is no free trail. However, you will get 20 free credits as soon as you sign up.

StockMock is an online platform that helps traders and investors test backtest option strategy. You can backtest strategies with different indicators for NSE stocks. The reports include backtesting dates, average trades, total returns, cumulative percentage gain/loss, and many other metrics.

StockMock Features

- StockMock provides Banknifty data from 2 Jan 2017

- Nifty data is available from 15 Feb 2019

- Access simulator data from 1 Jan 2021

StockMock Option Backtesting Features

- EOD and Multi-frame strategies

- Detailed analysis charts

- Multiple Filtering Options

- Optimized versions

StockMock Pricing: StockMock offers a ₹700 credit plan

StockMock Pros:

- Smooth User Interface

- Dedicated Support

- Currency Options

StockMock Con: Stock Mock is a dedicated online backtesting software. It is not useful for any other charting or technical analysis.

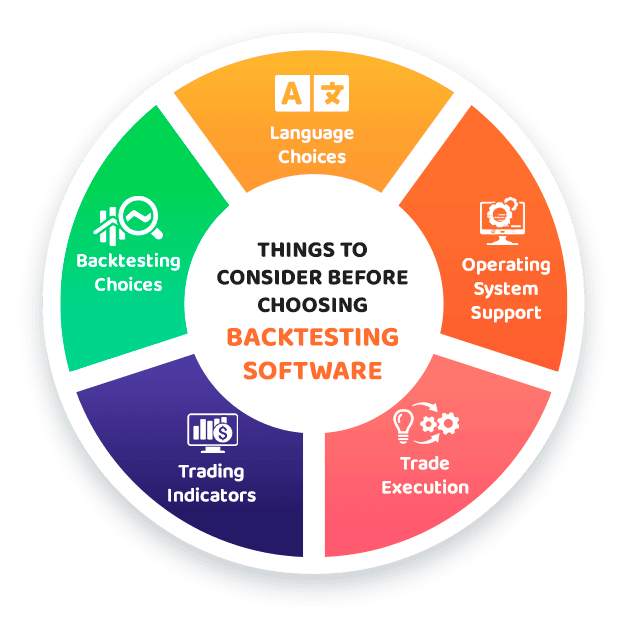

Things to Consider Before Choosing Backtesting Software

A good backtesting software must have a user-friendly interface and should provide statistical results to measure the strategy's effectiveness.

- Language choices

Some option backtesting software do not require a lot of programming skills for custom backtesting, while others need users to understand the coding language completely.

Those without a tech background might find it a bit difficult and take time to learn software that requires programming knowledge like C, Java, or Python.

- Operating system support

You must check the compatibility of the backtesting software with your operating system. While most back test trading strategies are web-based, some even offer Windows software and mobile apps for iOS/ Android for backtesting on the go.

- Trade execution

There are several ways to enter or exit a market. Depending on your preference, you may choose the back testing software that offers manual, semi-automatic, and automatic trade execution. Only a few vendors provide automatic trade execution.

- Trading indicators

The back testing software must offer a wide range of indicators like Total Gain Loss Ratio, Total Return on Equity (ROE), Annualized ROE, Total Profit and Loss, Risk-Adjusted Returns, and Volatility. It is essential to understand the market direction before making any decision.

- Backtesting choices

To select the right market to trade in, you might want to backtest entire markets at once instead of just single equities or forex pairs. However, this is not available in many backtesting software.

Also, some backtesting software only supports a single financial instrument. Such backtesting software solutions are unsuitable for those who want support for multiple financial instruments.

- Optimization

The backtesting software should support the easy creation and optimization of backtested strategies. Building a strategy should not be too time consuming for a beginner. Also, optimization is necessary to gain maximum profits.

Suggested Read: Best Technical Analysis Software for Stock Trading in India

Conclusion

If you want to be a successful trader, you must combine your trading knowledge with backtesting software to make the right decisions.

However, remember that the results are hypothetical and do not guarantee that the strategy would produce a similar outcome on actual implementation.

Backtesting software provides you with data but what you do to make your strategy effective depends on you.

FAQs

- What are the best free backtesting software for stocks?

Backtesting software like TradingView, Ninja Trader, and TradeBrains offer free plans that can be used to backtest trading strategies for stocks.

- What are the best free backtesting software for options?

OptionStack is a free backtesting software for options. Clients can backtest their strategies on Interactive Brokers Option Strategy Lab for free.

- Which platform is best for backtesting?

AmiBroker, Zerodha Streak, Trade Station, and TradersCockpit are some good platforms for backtesting.

- Where can I backtest for free?

Ninja Trader, TradeBrains and TradingView are some of the few TA software that allows users to backtest options and equity for free. However, they might determine the maximum number of backtest per day.

- How do I do a backtest in Excel?

You can make or download a backtesting template in excel. Then you can extract and feed historical data of any stock to the excel sheet and change various parameters to Backtest the stock.

Source: https://www.techjockey.com/blog/best-backtesting-software

0 Response to "Simple and Easy Free Backtester for Stock Trading Strategies"

Post a Comment